Mortgage Rates Just Hit a 12-Month Low

Mortgage Rates Just Hit a 12-Month Low— Here's What That Means If You're Buying Your First Home

What do falling mortgage rates mean for first-time home buyers right now?

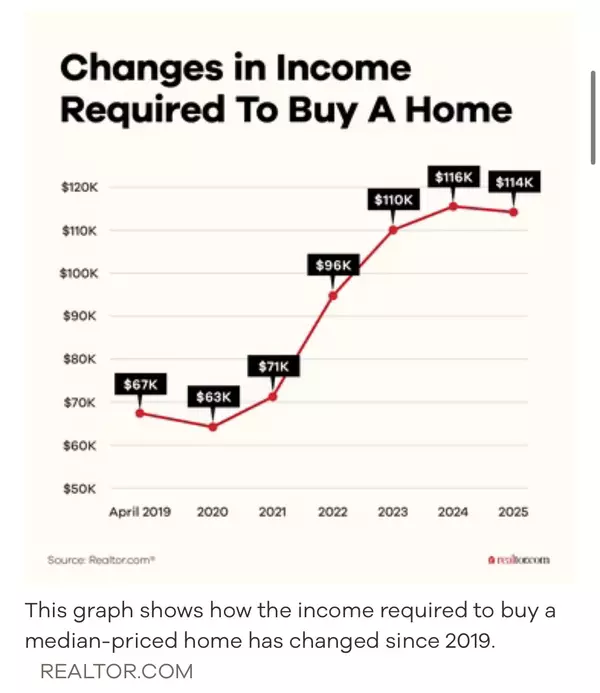

Falling mortgage rates can significantly increase your buying power, especially if you're navigating the market for the first time. With average rates hitting a 12-month low, this shift could be your window to move from renting to owning — particularly along the Gulf Coast of Alabama and Florida.

Why Mortgage Rates Matter More Than You Think

Your mortgage rate affects more than your monthly payment. Even a 0.5% drop in rates can save you thousands over the life of your loan. And right now, rates are the lowest they’ve been in more than a year, according to a new report from Homes.com.

As of October 2025, the average 30-year fixed mortgage rate has dipped well below 7%, giving buyers a much-needed break in affordability. This trend is especially encouraging for first-time buyers who have been sidelined by rising rates and home prices in recent years.

What’s Fueling the Drop in Rates?

Economic uncertainty and signs of cooling inflation are prompting lenders to lower interest rates. The Federal Reserve has recently paused rate hikes, signaling a possible softening in monetary policy. This has created a ripple effect — bringing mortgage rates down and breathing life into buyer activity.

If you’ve been waiting for the right time to buy, this could be it.

More Homes, More Choices

We’re also seeing increased inventory along the Gulf Coast of Alabama and Florida — meaning you’re not just getting better rates, but also more selection. This is especially important if you’re hoping to find a starter home that fits your lifestyle and budget.

Combine more listings with lower rates, and your timing couldn’t be better.

What You Should Do Next

If you're serious about buying your first home, here’s what you should do right now:

- Connect with a local expert: Work with someone who understands the nuances of the Gulf Coast market.

- Get pre-approved: Know what you can afford with today’s rates.

- Start touring homes: Properties are moving again, and competition is heating up.

As a trusted first-time home buyer expert, I specialize in helping people just like you make smart, informed moves in this market.

Final Thoughts

With mortgage rates at a year-long low and inventory opening up, now is a powerful moment for first-time buyers on the Gulf Coast. If you've been waiting for the "right time," this is your sign to take action.

Ready to take the next step?

Let’s talk through your options. I’d love to help you get started on your path to homeownership. Click here to book a free call with me and let’s create a game plan that works for you.

Categories

Recent Posts