The Wealth Gap Between Homeowners and Renters Just Got Wider: What You Need To Know

🏡 The Wealth Gap Between Homeowners and Renters Just Got Wider: What You Need To Know

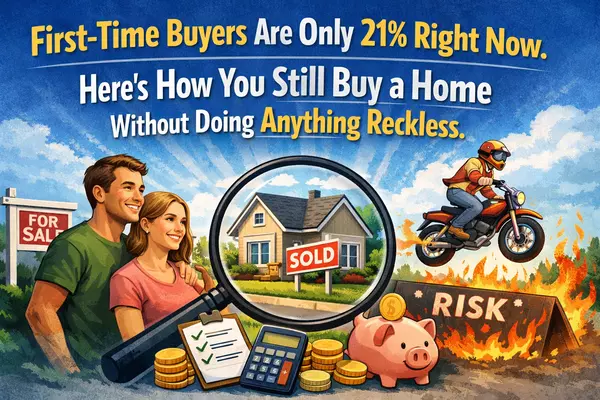

A recent study from the Federal Reserve, shared in this Realtor.com article, reveals a staggering statistic: the median net worth of homeowners in the U.S. is now nearly 40 times higher than that of renters.

Let’s break down what this means—and what you can do with this information.

💰 Homeownership = Long-Term Wealth

According to the 2022 Survey of Consumer Finances:

-

Median homeowner net worth: $396,200

-

Median renter net worth: $10,400

That’s a 38x difference—a sharp increase from 2019’s already wide gap of 36x.

Why the jump? While inflation and rising home prices have played a role, the key takeaway is this:

📈 Owning a home builds equity—renting does not.

🔎 What Contributes to This Wealth Gap?

-

Equity growth: Homeowners gain value over time just by paying their mortgage.

-

Stable housing costs: Fixed mortgage payments offer long-term financial predictability.

-

Forced savings: Each mortgage payment reduces principal and builds net worth.

-

Appreciation: Many homeowners saw double-digit appreciation during the pandemic years.

-

Tax advantages: Mortgage interest deductions and property tax write-offs can help.

😕 But What About Renters?

Renters often face rising costs with no return on that money. And with fewer assets and less financial stability, renters may find it harder to invest or save.

This doesn’t mean renters can’t build wealth—but the path is typically longer, more volatile, and dependent on alternative investment strategies.

🛠 So What Can You Do?

If you’re renting and want to close that gap:

-

Start exploring low or no down payment loan options (FHA, USDA, VA).

-

Consider first-time homebuyer programs in your area.

-

Talk to a trusted lender about your credit and budget.

-

Partner with a buyer’s agent who can help you plan strategically.

💡 You don’t have to buy a forever home to build wealth—you just have to start.

🎯 Bottom Line

Owning a home isn’t just about having a place to live—it’s about securing your financial future. And as this study shows, the sooner you start, the bigger the impact.

Want help getting started, or just curious about what’s possible for your situation?

Give me a call or send me a text....I'll be glad to help you run the numbers....consulations are always free!!

Categories

Recent Posts