Mortgage Rates Just Slipped Under 6% (Briefly): What That Means for You on the Gulf Coast

Mortgage Rates Just Slipped Under 6% (Briefly): What That Means for You on the Gulf Coast

If you saw the headline and thought, “Okay… so do I buy right now?” — deep breath.

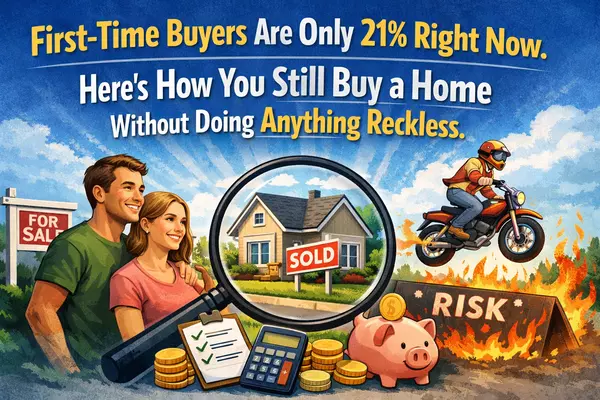

Daily mortgage rates dipped on Friday, January 9, 2026, breaking 6% for the first time since 2022, according to Mortgage News Daily data cited by Homes.com.

At one point, the 30-year fixed hit 5.99% and the 15-year fixed hit 5.55% — then the 30-year inched back up to 6.06% by Friday afternoon.

Translation: this is a meaningful moment… but also a reminder that rates can move fast.

First: daily rates are jumpy (and that’s normal)

Weekly averages smooth things out. Daily rates? They can swing on headlines, investor reactions, and plain old market weirdness.

So if you’re making decisions based on one day’s number, you’re basically letting your mortgage timeline be run by the internet. Hard pass.

Why did rates dip like this?

Homes.com tied Friday’s drop to market reaction after President Trump said he told “his representatives” to buy $200 billion in mortgage bonds (with the goal of lowering rates), though it wasn’t clear which agency would do it.

Multiple lenders quoted in the piece said the dip is likely temporary — and warned against “false urgency” from the rush of headlines.

I’m never here to argue politics. I’m here to keep you from making a six-figure decision off a hot-news spike.

What this actually means for you (buyer edition)

A dip under 6% can help — especially if you were shopping around 6.5–7% earlier.

But the smartest move isn’t “BUY TODAY.” The smartest move is:

1) Re-run your payment (with real Gulf Coast costs)

Along the Alabama/Florida Gulf Coast, your payment is more than principal + interest. You also want to price in:

-

homeowners insurance (and sometimes wind coverage)

-

flood insurance (depending on location/lender)

-

taxes

-

HOA (common with condos/townhomes)

Not fear-mongering. Just reality.

2) Shop your payment comfort, not the headline

The difference between “approved for” and “comfortable with” is where financial stress lives.

Pick a monthly number that still leaves room for life: groceries, travel, pets, and hurricane-season surprises.

3) Ask your lender these 3 questions this week

-

“If I lock now, how long is the lock?”

-

“What does it cost to lock?”

-

“If rates drop after I lock, do I have a float-down option?”

Homeowner edition: should you refinance?

If you’re sitting on a 7%+ rate (and some folks are), even a temporary dip might be worth a quick math check. Homes.com noted the drop could make a “meaningful difference” for borrowers carrying higher rates.

Refi only makes sense if it improves your life after costs. A lender can run break-even math fast.

Bottom line

Today’s dip under 6% is good news — but it’s not a starting gun.

Use it to:

-

update your numbers,

-

tighten your plan,

-

and make decisions based on what you can afford comfortably — not what a headline says at 3:51 PM.

If you want, I’ll help you run a no-pressure “does this change anything for me?” check based on your price range + location + realistic monthly costs.

—

Katie Ragland / 256-366-6974 / Real Broker, LLC

https://linktr.ee/katieraglandrealtor

Categories

Recent Posts