Why 2025 Is a Tough Market for First-Time Buyers — And What You Can Do About It

Why 2025 Is a Tough Market for First-Time Buyers — And What You Can Do About It

What’s driving the biggest drop in first-time homebuyers in over 40 years, and how can you navigate the current market divide?

A recent NAR survey revealed that first-time buyers now make up just 21% of the market — the lowest share since the data was first tracked. Rising prices, tighter inventory, and increased competition from cash buyers are reshaping the path to homeownership. But with the right strategy, you can still secure the keys to your first home.

What the Latest Housing Data Says

According to the National Association of REALTORS®, the median age of a first-time homebuyer is now 35, and the typical down payment is 8%. Compare that to repeat buyers, who are usually 58 years old with a median down payment of 20%. The takeaway? Today’s market is much harder to break into if you’re just getting started.

The report also showed:

-

26% of homes are bought in all-cash deals — a major hurdle for buyers using financing

-

One-third of recent buyers skipped using an agent entirely (and often overpaid or underperformed)

-

Many first-time buyers are still determined but feel overwhelmed or unsure of where to begin

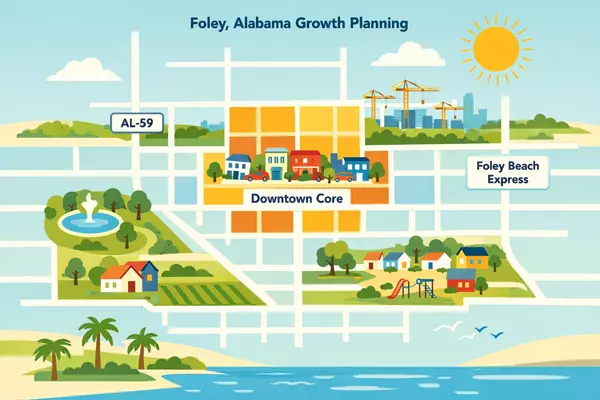

Why the Gulf Coast Market Is Especially Competitive

Here in Elberta, Foley, Gulf Shores, and Pensacola, the market reflects the national trend — but with unique local pressure. High demand for vacation homes and investment properties means more cash offers and quicker turnaround times.

If you’re buying for the first time, you’re not just competing with other local buyers — you’re up against seasoned investors and out-of-town cash buyers who know how to move fast. That’s why having a clear plan and local support matters more than ever.

Don’t Go It Alone — Here’s What You Can Do

If you’re thinking of buying your first home, you need more than just pre-approval. You need a strategy. That includes:

-

Understanding how to make your financed offer more competitive

-

Knowing which neighborhoods are gaining value (and which are overhyped)

-

Timing your move around seasonal trends and seller motivations

-

Avoiding the common pitfalls that cost first-time buyers thousands

This isn’t the market to “see what happens.” It’s the market to be smart, prepared, and proactive.

Final Takeaway: It’s Not Hopeless — It’s Just a Challenge

Yes, the data shows a clear divide between first-time buyers and repeat buyers. But the story isn’t all doom and gloom. The buyers who succeed right now are the ones who get educated, get strategic, and get the right guidance from someone who knows the local market inside and out.

Want a personalized game plan to buy your first home?

Contact me for a strategy session — let’s map out the smartest path to get you home.

Or join my next Gulf Coast Homebuyer's Webinar for help avoiding the most common and expensive mistakes when buying a home!

Categories

Recent Posts