Mortgage Rates Just Slipped Under 6% (Briefly): What That Means for You on the Gulf Coast

Mortgage Rates Just Slipped Under 6% (Briefly): What That Means for You on the Gulf Coast If you saw the headline and thought, “Okay… so do I buy right now?” — deep breath. Daily mortgage rates dipped on Friday, January 9, 2026, breaking 6% for the first time since 2022, according to Mortgage News D

Read More-

If you’ve been trying to buy your first home lately and it feels like everyone else has a cheat code… you’re not imagining it. According to the National Association of REALTORS® 2025 Profile of Home Buyers and Sellers, first-time buyers made up just 21% of purchases — the lowest share on record. The

Read More Why Zillow Estimates Aren’t Local (and What Actually Moves Value on the Gulf Coast)

Online Home Value Estimates Aren’t Local (Here’s What Actually Moves Value on the Gulf Coast) If you’ve ever looked up your home online and thought, “Wait… that is what it says my house is worth?” — you’re not alone. Online estimates can be a helpful starting point, but on the Gulf Coast, they often

Read MoreMortgage Rates Hit a 2025 Low: What That Actually Means for You Now in 2026

Opening question: Mortgage rates dipped—so should you buy now, refinance, or just ignore the noise? Snippet answer: Rates dropping is helpful, but it’s not a magic wand. The smart move is using the dip to tighten your numbers, improve your options, and make decisions based on your monthly comfort—no

Read MoreWaiting for Mortgage Rates to Drop? Here’s the Plot Twist Buyers Miss

Waiting for Mortgage Rates to Drop? Here’s the Plot Twist Buyers Miss Opening question: “Should I wait for mortgage rates to fall before I buy?”Snippet answer: Maybe… but “waiting for rates” can be a shaky strategy. Rates don’t move on your timeline, and sometimes the bigger leverage is price, inven

Read MoreWhy Many Are Delaying Homeownership — and How You Can Move Forward Now

Why Many Are Delaying Homeownership — and How You Can Move Forward Now Opening question:Why are so many potential buyers putting off major life milestones until they own a home? Snippet answer:A recent survey found that about 71% of aspiring homeowners are postponing big decisions—such as marriage,

Read MoreThe Wealth Gap Between Homeowners and Renters Just Got Wider: What You Need To Know

🏡 The Wealth Gap Between Homeowners and Renters Just Got Wider: What You Need To Know A recent study from the Federal Reserve, shared in this Realtor.com article, reveals a staggering statistic: the median net worth of homeowners in the U.S. is now nearly 40 times higher than that of renters. Let’s

Read MoreHome Inspection Contingency 101: What Every Buyer Should Know Before Closing the Deal

🛠️ Home Inspection Contingency 101: What Every Buyer Should Know Before Closing the Deal You've finally found the one—your dream home with the wraparound porch, beachy vibes, or that perfect backyard for your pup. But before you pop the champagne, there’s one crucial step you shouldn’t skip: the ho

Read MoreNew Homeowner Lifesaver? What You Need to Know About Home Warranties

🛠️ What Does a Home Warranty Actually Cover? Buying a home is one of life’s biggest adventures—but let’s be real: when something breaks unexpectedly, it can quickly go from exciting to expensive (or at the very least, stressful). That’s where a home warranty comes in. Think of it as a financial saf

Read MoreShould You Buy Down Your Mortgage Interest Rate? Here’s What You Need to Know

🏠 Should You Buy Down Your Mortgage Interest Rate? Here’s What You Need to Know Buying a home is one of the biggest financial decisions you’ll ever make—and understanding all your options can help you save thousands over the life of your loan. One option that often gets overlooked? Mortgage buydown

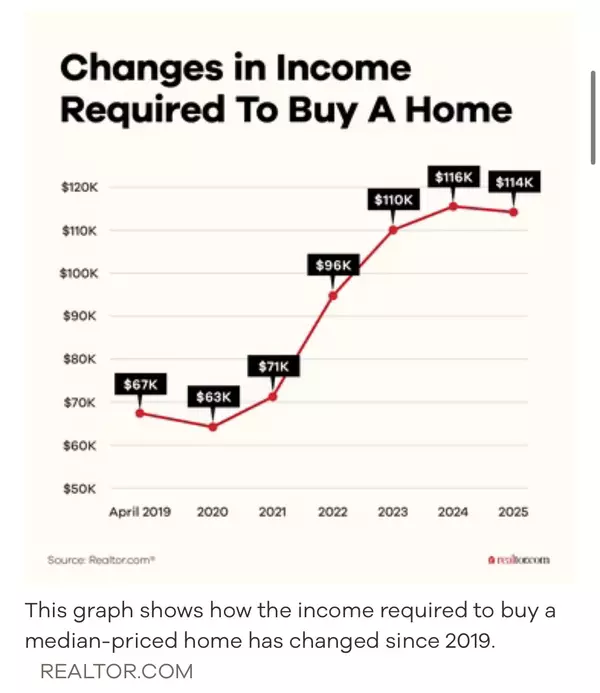

Read MoreWhy Buying a Home in 2025 Requires More Income—And How to Navigate It Like a Pro

Home Affordability in 2025: What's Changed and What You Can Do About It Opening Paragraph:If you’ve been watching the housing market and wondering, “Why does buying a home feel so much harder than it used to?”—you’re not alone. According to a new report from Realtor.com, homebuyers now need to earn

Read More

Categories

Recent Posts